Obtaining Copy Of Bankruptcy Discharge Papers Can Be Fun For Anyone

Wiki Article

What Does Copy Of Chapter 7 Discharge Papers Do?

Table of ContentsThe 10-Minute Rule for How Do You Get A Copy Of Your Bankruptcy Discharge PapersThe 6-Minute Rule for Chapter 13 Discharge PapersHow To Get Copy Of Bankruptcy Discharge Papers Fundamentals ExplainedThe Buzz on Obtaining Copy Of Bankruptcy Discharge Papers

trustee program is carried out by the Division of Justice. For purposes of this magazine, references to united state trustees are additionally appropriate to insolvency managers. A fee is billed for transforming, on request of the debtor, a situation under chapter 7 to an instance under phase 11. The fee billed is the distinction between the declaring charge for a chapter 7 and also the filing cost for a phase 11.

1930(a). Presently, the difference is $922. Id. There is no charge for transforming from phase 7 to phase 13. Unprotected financial obligations usually may be defined as those for which the expansion of credit report was based totally upon an evaluation by the creditor of the debtor's capacity to pay, instead of protected financial debts, for which the expansion of credit rating was based upon the lender's right to confiscate collateral on default, in enhancement to the debtor's capacity to pay.

The offers for monetary products you see on our platform come from companies who pay us. The money we make helps us provide you accessibility to cost-free credit report as well as records and helps us develop our other fantastic devices and educational products. Settlement may factor into just how as well as where items appear on our platform (and in what order).

8 Simple Techniques For Chapter 13 Discharge Papers

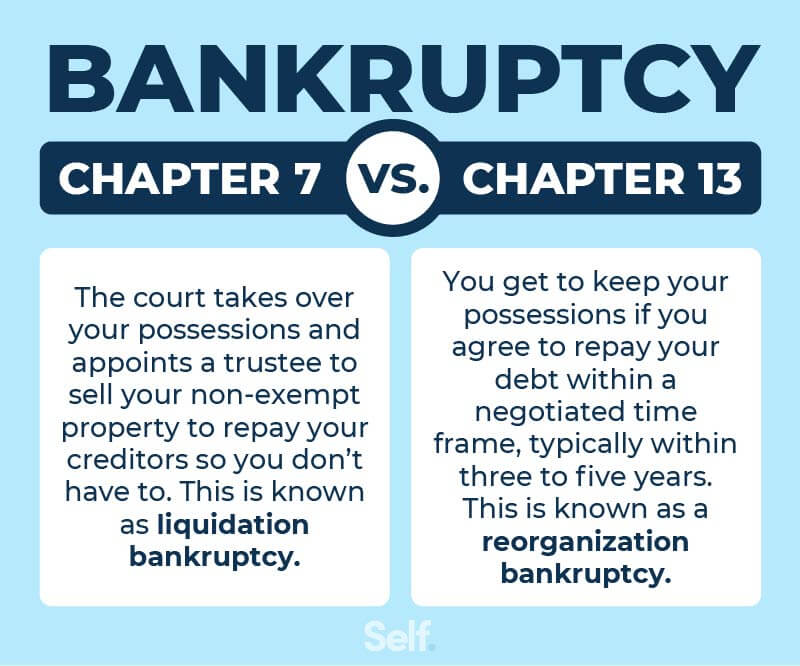

That's why we give functions like your Approval Probabilities and cost savings estimates. Of training course, the offers on our system don't represent all monetary items available, but our objective is to reveal you as numerous great options as we can. The primary step in establishing whether a bankruptcy is appropriate for you is defining what it is.Discharge is the legal term meaning you're not legally required to pay the financial debt, and collection agencies can't take any additional action to gather it. Adhering to an insolvency discharge, financial debt collection agencies and loan providers can no more attempt to accumulate the discharged debts. That implies say goodbye to calls from collection agencies and no even more letters in the mail, as you are no longer personally accountable for the debt.

With a secured debt, the loan is connected to an asset, or security, that lending institutions can take if you quit paying. https://www.ulule.com/b4nkruptcydc/#/projects/followed. Unprotected debt is not backed by security, so lenders don't have the same option (chapter 13 discharge papers). If you really feel the crushing weight of charge card debt as well as an auto loan on your shoulders, a bankruptcy could be a sensible option thinking you recognize the effects.

An insolvency will certainly continue to be on your credit report records for up to either seven or 10 years from the date you file, depending on the type of insolvency. Are determined based on the info in your credit rating reports, a bankruptcy will certainly affect your debt scores.

7 Easy Facts About Copy Of Bankruptcy Discharge Explained

For more details, look into our short article on what occurs to anchor your credit score when you declare personal bankruptcy. A released Chapter 7 personal bankruptcy as well as a discharged Phase 13 bankruptcy have the same influence on your credit history, though it's possible a lending institution could look more favorably on one or the other.Obtaining rid of financial debt collection agencies is a wonderful benefit, yet you might invest the bulk of 10 years repairing your credit scores. A bankruptcy discharge may be properly for you to get out of debt. Consider other courses to debt flexibility and monetary security, such as a financial obligation negotiation or a financial debt repayment plan, prior to selecting bankruptcy as the ideal way ahead.

He has an MBA in financing from the University of Denver. When he's far from the keyboard, Eric takes pleasure in discovering the globe, flying tiny Find out more (https://zzb.bz/ocAdE)..

Find out more concerning debts discharged at the end of Phase 13 insolvency. Noand several find this reality surprising. Rather than noting the wiped-out financial obligations, the order will provide general info about financial obligation groups that don't go away in bankruptcy or "nondischargeable financial debt." It will explain that you'll likely continue to be accountable for paying: residential support commitments (spousal or kid assistance) most pupil financings and also tax financial debt accounts that the court decides you can't discharge most penalties, fines, and criminal restitution some financial debts that you fell short to provide correctly particular fundings owed to a retired life strategy cash owed as a result of wounding somebody while running a vehicle while intoxicated, as well as liabilities covered by a reaffirmation contract (a court-approved arrangement to continue paying a financial institution).

Our Chapter 13 Discharge Papers Diaries

Obligations emerging from scams devoted by the borrower or accident triggered by the borrower while intoxicated are financial obligations that the court could state nondischargeable. Although a discharge eases you of your duty to pay a financial debt, it won't eliminate a lien that a creditor may carry your home (https://bitcointalk.org/index.php?action=profile;u=3496867;sa=summary).Some liens can be eliminated, nevertheless, also after the closure of the insolvency instance - how do i get a copy of bankruptcy discharge papers. A regional insolvency lawyer will be able to encourage you about your options. Learn extra in What Takes place to Liens in Phase 7 Bankruptcy? After the court provides the discharge, creditors holding nondischargeable financial debts can proceed collection efforts.

The information permits the lender to verify the bankruptcy which the discharged financial obligation is no more collectible. You'll locate the filing date and also instance number at the top of almost any paper you receive from the court. The discharge day will certainly appear on the left-hand side of the discharge order promptly beside the issuing court's name (you'll find the instance number in the top box).

Report this wiki page